CKNW homepage

-

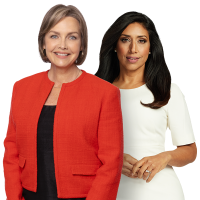

Listen Live Global News Morning BC 5:00 AM - 5:30 AM

Listen Live Global News Morning BC 5:00 AM - 5:30 AM -

Up Next Mornings with Simi 5:30 AM - 9:00 AM

Up Next Mornings with Simi 5:30 AM - 9:00 AM -

The Mike Smyth Show 9:00 AM - 12:00 PM

The Mike Smyth Show 9:00 AM - 12:00 PM -

The Jill Bennett Show 12:00 PM - 3:00 PM

The Jill Bennett Show 12:00 PM - 3:00 PM -

The Jas Johal Show 3:00 PM - 6:00 PM

The Jas Johal Show 3:00 PM - 6:00 PM -

Global News Hour at 6 6:00 PM - 6:30 PM

Global News Hour at 6 6:00 PM - 6:30 PM -

Global National 6:30 PM - 7:00 PM

Global National 6:30 PM - 7:00 PM -

A Little More Conversation with Ben O’Hara-Byrne 7:00 PM - 10:00 PM

A Little More Conversation with Ben O’Hara-Byrne 7:00 PM - 10:00 PM -

Let's Talk 10:00 PM - 1:00 AM

Let's Talk 10:00 PM - 1:00 AM -

Tomorrow Curiouscast Podcast Hour 1:00 AM - 2:00 AM

Tomorrow Curiouscast Podcast Hour 1:00 AM - 2:00 AM -

A Little More Conversation with Ben O’Hara-Byrne 2:00 AM - 5:00 AM

A Little More Conversation with Ben O’Hara-Byrne 2:00 AM - 5:00 AM -

Global News Morning BC 5:00 AM - 5:30 AM

Global News Morning BC 5:00 AM - 5:30 AM